Market changes in media monitoring

Monday, July 7, 2014 at 10:01

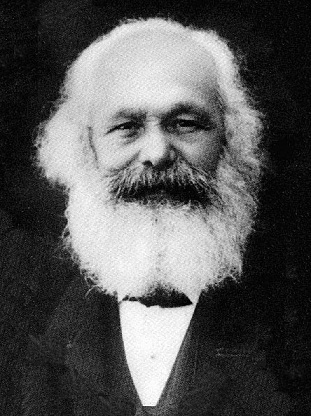

Monday, July 7, 2014 at 10:01  Karl Marx talked of the inexorable centralization and concentration of capital. Media monitoring, like other industries, has seen huge changes in the past 15 years. Advanced technology has replaced scissors and glue, and businesses have invested to keep up with client demand for ever more sophisticated monitoring and evaluation services. In the UK and across the globe the much derided venture capital industry has provided the finance for major players to restructure their businesses, but now a wave of ownership changes have been announced or are in prospect.

Karl Marx talked of the inexorable centralization and concentration of capital. Media monitoring, like other industries, has seen huge changes in the past 15 years. Advanced technology has replaced scissors and glue, and businesses have invested to keep up with client demand for ever more sophisticated monitoring and evaluation services. In the UK and across the globe the much derided venture capital industry has provided the finance for major players to restructure their businesses, but now a wave of ownership changes have been announced or are in prospect.

Precise, UK no 2 by market share, has been sold to WPP-owned Kantar. Cision, a major international brand and formerly UK no 3 (then known as as Romeike - one of the grand old names of press cuttings), is being bought and merged with Vocus, also US based but a growing presence in the UK. Added to the mix, Gorkana (formerly Durrants) the UKs largest player, is for sale. So it’s a good time for the money men. What does it mean for the clients?

The NLA view is that UK clients have been fortunate to have a vibrant and competitive media monitoring industry, with more suppliers and choice than in many other markets. An environment that encourages investment sustains that choice, as does a clear and simple copyright structure. The fact that MMOs can start a business in the UK with an NLA licence and the NLA eClips service has encouraged new entrants, some of which have grown to become major players. It is notable that countries where copyright is weakest have the poorest services for PR users, since without remuneration, publishers aren’t in a position to stump up multi-million pound investment in databases for MMO’s. But why would you invest when there is uncertainty over rights? Too much concentration of supply would be a concern, but, as with a fair number of Karl Marx’s predictions, we are some way from that.

So we think clients should welcome change, and the energy and investment that a new generation of owners will bring. Bring it on.

Andrew Hughes | Comments Off |

Andrew Hughes | Comments Off |